A Freelancer's Guide to Discounted Cash Flow

At its heart, discounted cash flow (DCF) is a way to figure out what an investment is worth today based on the cash it's expected to make in the future. It’s built on a simple, universal truth: a euro in your hand right now is worth more than a euro you’ll get a year from now. Why? Because you can put today’s euro to work—investing it, paying down debt, or simply earning interest.

Think of it as a financial time machine for your freelance business.

Why Discounted Cash Flow Is a Freelancer's Secret Weapon

Let's imagine a client offers you two ways to get paid for a big project. You can take €10,000 as soon as you finish, or you can wait a year and get €10,500. The bigger number looks tempting, doesn't it? But this is exactly where a discounted cash flow mindset helps you see beneath the surface.

This all comes down to the time value of money. Cash today is king, not just because it feels good to have it, but because it holds potential. That €10,000 could be invested to grow, used to clear a high-interest credit card balance, or put back into your business to land even bigger projects. The future is always a little uncertain, and inflation can chip away at the value of money over time.

Putting Theory into Practice

For a freelancer, this isn't some dusty concept from a finance textbook. It has real-world implications that can directly influence your bottom line and shape how you run your business. Getting comfortable with DCF helps you:

- Properly Vet Long-Term Contracts: Is that multi-year deal with payments spread out over time really as lucrative as it looks on paper? DCF cuts through the noise and tells you its value in today's euros.

- Negotiate Smarter Payment Terms: When a client suggests a staggered payment plan, you can use a quick DCF calculation to show why you need a slightly higher total fee to make up for the delay.

- Understand Your Business's Worth: If you ever dream of expanding your freelance gig into a small agency or selling it one day, DCF is the tool you'll use to put a realistic price tag on it.

- Make Better Investment Choices: Deciding between new software, an expensive training course, or a marketing campaign? DCF helps you compare the potential future payoffs of each option side-by-side.

In essence, DCF analysis is about turning future possibilities into a concrete number you can act on today. It gives you a solid, data-backed way to justify your decisions and make sure you’re putting your time and money where they’ll work hardest for you.

More Than Just a Formula

It’s easy to feel a bit intimidated by the jargon and formulas that often come with DCF. But the idea behind it is incredibly intuitive. It’s like planning a long road trip—you don't just focus on the destination. You have to think about the cost of fuel, the possibility of detours (risks), and how long the journey will take.

In the same way, DCF doesn't just look at the final payout. It accounts for the entire journey that money takes through time, adjusting its value based on the risks and missed opportunities along the way. By the time you finish this guide, you’ll see DCF not as a scary equation, but as a powerful lens to bring your financial future into focus.

Getting to Grips with the Core Parts of a DCF

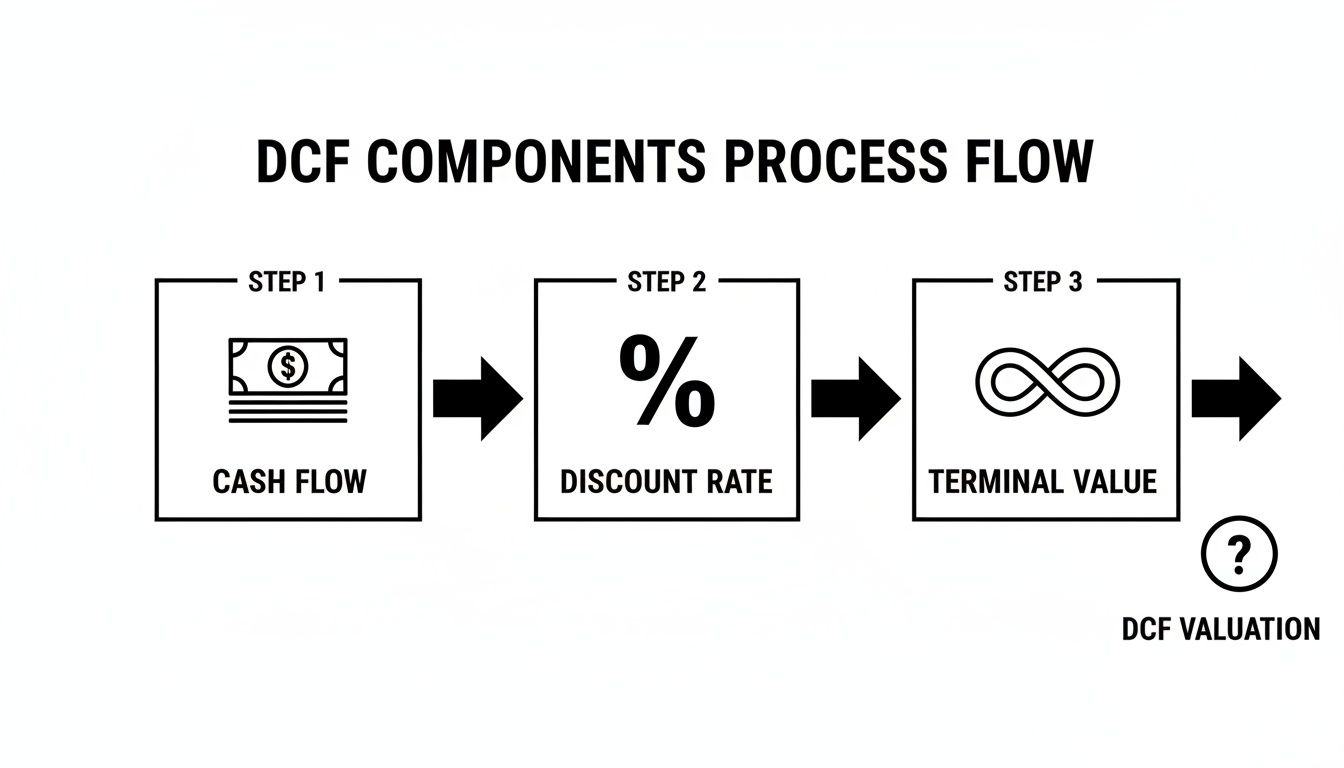

You don’t need a finance degree to run a discounted cash flow analysis, I promise. You just need to get comfortable with its three main building blocks. Think of them as the key ingredients in a recipe—if you get these right, you’ll end up with a solid valuation of your future earnings.

The three core components are:

- Free Cash Flow (FCF): The actual, spendable cash your business generates.

- The Discount Rate: A percentage that accounts for risk and the time value of money.

- Terminal Value: A smart estimate of your business's worth beyond your initial forecast.

Let's unpack each one, ditching the jargon and building your understanding piece by piece.

Free Cash Flow: Your Business's Lifeblood

This is the single most important number in a DCF valuation. Forget about 'profit' for a second. Free Cash Flow (FCF) is the real cash left in your bank account after you’ve paid all your operating expenses and made any investments needed to keep things running (like buying a new laptop).

It’s the true 'take-home pay' of your business. It's the money available to you as the owner to reinvest, pay down debt, or simply take as a dividend. Calculating FCF is vital because it cuts through accounting fluff and shows what you actually earn. Your first step will be to project this number for a set period, usually three to five years down the road.

The Discount Rate: Accounting for Risk and Time

The discount rate is the engine of the whole discounted cash flow model. It's the percentage you use to translate future cash into its value today. A higher discount rate means future cash is worth less in today's terms, which reflects greater risk or other missed opportunities.

So, how on earth do you pick this number? It’s a bit of an art, but it boils down to two key ideas:

- Opportunity Cost: What return could you get on your money if you put it somewhere else with a similar level of risk? Think of it as the return you’re giving up by tying your money to this specific venture.

- Risk Premium: How certain are you about your projected cash flows? A freelancer with one massive, unpredictable client is taking on a lot more risk than one with ten smaller, retainer-based clients. The more uncertain things are, the higher the risk premium you should add.

For instance, a low-risk project might use a discount rate of 8%. A much riskier new venture, on the other hand, could easily justify a rate of 15-20% or even higher. Nailing this rate is fundamental to ensuring your pricing for freelance projects properly reflects both your time and the risks involved.

Terminal Value: What's Your Business Worth in the Long Run?

Let's be realistic—you can't predict your free cash flow forever. That's where Terminal Value comes in. It's a calculated guess of your business’s value for all the years after your initial forecast period ends (say, from year six onwards, forever).

It’s really just a logical shortcut. Instead of guessing your cash flow in year 20, you assume that after your detailed forecast period, your business will grow at a stable, modest rate for the foreseeable future. This rate is usually a conservative number tied to long-term economic growth, like 2-3%.

Terminal Value is often the biggest single piece of a DCF valuation. It recognises that a successful business has a life beyond a five-year spreadsheet, capturing all that long-term potential in one manageable figure.

This concept is particularly relevant in stable economic environments. In Luxembourg, a major EU financial centre, DCF is essential for valuing the huge capital inflows that define its economy. Historical data shows Luxembourg's capital and financial account averaged a surplus of €789.38 million quarterly, peaking at an incredible €4644.39 million. This shows how DCF models, using low discount rates that reflect the region's stability, help investors and freelancers alike forecast the net present value of these huge cash flows. You can explore more about Luxembourg's capital flow data to understand these trends.

Calculating DCF With a Practical Walkthrough

Theory is great for understanding the 'what' and 'why', but the real magic happens when you roll up your sleeves and actually run the numbers. Let's move from concept to calculation and put the discounted cash flow model to work.

We’ll follow a freelance consultant who’s using DCF to figure out the true value of a potential three-year client contract. This practical example will break the process down into simple, manageable steps, showing you exactly how to connect future earnings to a concrete value in today’s money.

Step 1: Projecting Future Free Cash Flows

First things first, our consultant needs a solid estimate of the Free Cash Flow (FCF) this project will generate each year. Remember, this isn't just the headline revenue figure; it's the actual cash left in their pocket after all project-specific expenses have been paid.

Let's say the project is set to bring in €25,000 in revenue annually. To get the job done, they'll have a few yearly costs:

- Software subscriptions: €1,200

- Project management tools: €600

- Subcontractor fees: €5,000

The annual FCF calculation is pretty straightforward:

€25,000 (Revenue) - €6,800 (Total Expenses) = €18,200

For this walkthrough, we’ll keep things simple and assume the FCF holds steady at €18,200 for all three years. In the real world, you might forecast some growth or fluctuation, but this keeps the focus on the core DCF mechanics.

As you can see, each of these pieces—the cash flow, the discount rate, and the eventual terminal value—is a crucial lever that directly shapes the final valuation.

Step 2: Choosing a Realistic Discount Rate

Next up is the discount rate. This little percentage is a big deal; it represents both the risk involved and the opportunity cost of taking on this specific project. A higher rate means future cash is worth less today, reflecting greater uncertainty or better alternatives.

Our consultant thinks it through:

- The client is a stable, well-known company (which lowers the risk).

- The project scope is crystal clear (less chance of things going wrong).

- However, committing to this for three years means saying no to other, potentially more lucrative gigs (that's the opportunity cost).

After weighing these points, they land on a discount rate of 8%. This feels right—it's a common baseline for a stable venture, balancing a reasonable return with a moderate level of risk. Getting this rate right is crucial, and if you're ever stuck, our guide on how to use a freelance rate calculator can help you think through all the variables that determine your true worth.

A Quick Example: A Simple 5-Year Freelance Project

To see how this works over a slightly longer period, let's look at another quick example. Imagine a freelancer lands a five-year contract with a consistent cash flow.

Simple DCF Calculation For A Freelance Project This table demonstrates a five-year discounted cash flow projection for a hypothetical freelance contract, showing how future cash flows are discounted to their present value.

| Year | Projected Free Cash Flow (€) | Discount Factor (at 8%) | Present Value of Cash Flow (€) |

|---|---|---|---|

| 1 | €20,000 | 0.926 | €18,520 |

| 2 | €20,000 | 0.857 | €17,140 |

| 3 | €20,000 | 0.794 | €15,880 |

| 4 | €20,000 | 0.735 | €14,700 |

| 5 | €20,000 | 0.681 | €13,620 |

| Total | €100,000 | €79,860 |

Even though the total cash collected will be €100,000, its value in today's terms, after accounting for risk and opportunity cost, is just under €80,000.

Step 3: Bringing It All Together With the DCF Formula

Okay, back to our original three-year project. We now have all the ingredients: the yearly cash flow and our discount rate. The formula for calculating the Present Value (PV) of each year’s earnings is:

Present Value = Future Cash Flow / (1 + Discount Rate)ⁿ Where 'n' is the number of years into the future.

Let’s plug in the numbers for our consultant’s project, year by year.

Year 1:

- PV = €18,200 / (1 + 0.08)¹

- PV = €18,200 / 1.08

- PV = €16,851.85

Year 2:

- PV = €18,200 / (1 + 0.08)²

- PV = €18,200 / 1.1664

- PV = €15,603.57

Year 3:

- PV = €18,200 / (1 + 0.08)³

- PV = €18,200 / 1.2597

- PV = €14,447.88

See how the present value of the same €18,200 shrinks each year? That’s the time value of money in action. The further away the payday, the less it's worth to you right now.

Step 4: Calculating the Total Project Value

This is the easy part. To find the total value of the project today, we just need to add up the present values we calculated for each year.

Total Present Value = PV of Year 1 + PV of Year 2 + PV of Year 3

Total PV = €16,851.85 + €15,603.57 + €14,447.88 Total PV = €46,903.30

So, while the project promises €54,600 in total free cash flow, its actual worth to the consultant today is €46,903.30. This DCF valuation gives them a powerful, data-backed figure to help them decide whether to take the project, negotiate better terms, or walk away in search of a more valuable opportunity.

How to Avoid Common DCF Valuation Mistakes

A discounted cash flow analysis is a fantastic tool, but there’s a catch: its final number is only as reliable as the assumptions you feed into it. A tiny error or a wildly optimistic guess can throw your entire valuation off, giving you a false sense of confidence or, worse, causing you to walk away from a genuinely good opportunity.

Think of it like building a house. If the foundation is wonky, the whole structure will be unstable, no matter how perfectly you build the walls and roof. DCF is no different—shaky assumptions lead to a shaky valuation.

Let's walk through some of the most common traps that freelancers and consultants fall into, and more importantly, how you can sidestep them to make sure your analysis is grounded in reality.

The Overly Optimistic Forecast

Easily the biggest mistake is the "hockey stick" projection. You know the one: revenues are flat for a while, and then suddenly they shoot for the moon with no real justification. It’s great to be ambitious, but your cash flow forecasts have to be believable.

Instead of just hoping for a windfall, anchor your projections in solid evidence.

- Past Performance: Take a hard look at your historical growth. Is a sudden 200% jump next year actually plausible?

- Market Reality: What’s a typical growth rate for someone in your field? Do you have new contracts signed or a solid client pipeline to back up those big numbers?

- Your Own Capacity: Can you physically handle the amount of work required to generate that projected revenue?

A strong forecast tells a convincing story. It shows steady, defensible growth, not an unexplained leap into the stratosphere.

Picking the Wrong Discount Rate

Choosing a discount rate can feel a bit like guesswork, but getting it wrong can completely warp your valuation. A rate that’s too low will make future cash flows seem more valuable than they are, while a rate that’s too high will unfairly shrink their worth.

The secret is to match the rate to the risk involved. A long-term contract with a blue-chip client is far less risky than juggling a series of one-off gigs in an unpredictable market, and your discount rate needs to reflect that. Don’t just grab a generic number like 10% out of thin air. Think critically about the specific risks tied to the work or business you're valuing.

A well-chosen discount rate isn't just a number; it's a measure of your confidence in the future. It quantifies the uncertainty and opportunity cost tied to your projected earnings, making your discounted cash flow valuation far more meaningful.

This is especially true in fast-moving economies. For example, DCF principles are crucial for navigating Luxembourg's private sector credit cycles. EUROSTAT data shows that credit flow, which hit a high of 133.00% of GDP in 2007, later swung to -12.70% by 2023. This highlights how DCF helps assess risks tied to economic shifts—in the same way Billzy's 90-day projections help you spot overdue invoices before they threaten your immediate cash flow.

Misunderstanding Sensitivity Analysis

Another common blunder is to treat the DCF output as a single, magic number. It’s not. Your valuation is an estimate built on a set of assumptions, and this is where sensitivity analysis becomes your best friend.

At its core, this just means tweaking your key assumptions—like the growth rate or discount rate—to see how much the final valuation changes. For instance, what happens to your project's value if growth is 2% lower than you hoped? What if you used a 12% discount rate instead of 10%?

By creating a range of possible outcomes (think best-case, worst-case, and most-likely scenarios), you turn your DCF from a rigid calculator into a dynamic decision-making tool. It gives you a much clearer, more realistic picture of the potential risks and rewards on the table.

Connecting DCF Strategy with Daily Cash Flow Management

A discounted cash flow analysis gives you a powerful, long-term map of your business's potential value. It’s your financial North Star, guiding big decisions like which projects to take on or how to price your services for future growth.

But a map is only useful if you can actually navigate the day-to-day journey. This is where high-level strategy meets the practical, on-the-ground reality of running your business. Your entire DCF valuation is built on a series of projected cash flows. The accuracy of that valuation hinges on one critical thing: making sure that projected cash actually arrives in your bank account, on time.

From Long-Term Vision to Short-Term Action

Think of your DCF model as the ‘why’—why you're building your business and what it could be worth down the line. Your daily cash flow management, on the other hand, is the ‘how’—the concrete steps you take every day to turn that vision into a reality. Without solid daily habits, even the most brilliant DCF projection is just a hopeful spreadsheet.

This is exactly why tools that offer immediate financial clarity are so important. While a DCF looks years ahead, something like Billzy’s 90-day cash flow forecast gives you an accurate picture of your immediate financial health. It helps you anticipate shortfalls, plan for upcoming expenses, and ensure you have the cash on hand to operate smoothly.

A DCF valuation tells you what your business could be worth. Effective daily invoice and cash flow management determines what it will be worth. The two are inextricably linked.

This connection is crucial for freelancers and small businesses, especially in dynamic financial hubs. Take Luxembourg's status as an EU financial centre; it highlights the importance of connecting long-term value with short-term cash realities. Annual gross flows in equity and investment fund shares there averaged an incredible 507% of domestic GDP between 2002 and 2016, with massive swings in capital. A DCF model helps value these volatile pipelines, while disciplined daily invoice tracking ensures the predicted cash actually materialises. You can read more about Luxembourg's capital flow dynamics to see how these principles apply on a larger scale.

Turning Projections into Paid Invoices

The numbers in your DCF forecast aren't just abstract figures; they represent real invoices that need to be sent, tracked, and collected. Every single delayed payment directly impacts the free cash flow you projected, chipping away at the very foundation of your valuation.

Here’s how to bridge that gap between your long-term model and daily execution:

- Systematic Invoice Tracking: Your DCF relies on predictable income. A central dashboard showing what's pending, due, and overdue is the first step to turning your forecasts into facts.

- Proactive Reminders: Don't wait for an invoice to become critically overdue. Automated reminders are essential for keeping your payment cycle healthy and your cash flow consistent.

- Clear Payment Terms: Your terms of service are the rules that govern your cash flow. Enforcing them, including applying late fees when necessary, protects the value you’ve worked so hard to calculate in your DCF.

Ultimately, mastering your finances as a freelancer means operating on two levels at once. You need the strategic, long-range perspective that a DCF analysis provides. At the same time, you need the tactical discipline to manage the daily financial activities that bring that long-term vision to life. For more immediate actions you can take, explore these essential cash flow tips for freelancers to strengthen your daily financial habits.

Common Questions About Discounted Cash Flow for Freelancers

Diving into discounted cash flow can feel a bit like learning a new language. The core ideas are fairly simple, but when you start applying them to your own freelance business, a few common questions always seem to pop up. Let’s walk through the big ones so you can feel confident using DCF to grow your business.

Getting these fundamentals right is what turns a DCF analysis from a dry academic exercise into a real strategic advantage.

How Accurate Is a DCF Valuation Really?

This is probably the most important question you can ask, and the answer is refreshingly honest: a DCF valuation is a powerful estimation tool, not a crystal ball. Its accuracy depends entirely on the quality and realism of the assumptions you feed it. As the old saying goes, garbage in, garbage out.

The real point of a discounted cash flow analysis isn't to land on a single, perfect number down to the last euro. Its true power is that it forces you to think critically about what actually drives the value of your business.

The process of building the DCF model—thinking through your future growth, potential risks, and long-term stability—is often more valuable than the final number itself. It helps you understand what levers you can pull to increase your business's value over time.

Think of it less like a precise scientific measurement and more like a well-informed weather forecast. It gives you a probable range of outcomes based on the data you have, helping you prepare for different scenarios instead of just crossing your fingers and hoping for the best. A DCF valuation gives you a solid framework for making smarter decisions, even when the future is uncertain.

Can I Use DCF for a Brand New Business?

You absolutely can. It’s true that DCF is easier when you have years of financial history to draw from, but it’s an incredibly useful exercise for new ventures and start-ups. You just need to adjust your approach slightly.

For a new freelance business without a track record, your projections will lean more heavily on what’s happening in the market around you and some smart scenario planning. Instead of looking backward at your own performance, you’ll look outward.

Here’s how you can build a credible forecast:

- Use Industry Benchmarks: Look up typical revenue growth, profit margins, and client acquisition costs for freelancers in your niche and region. This data gives you a realistic baseline to start from.

- Analyse Competitors: See what established freelancers or small agencies in your field are charging and the kinds of contracts they’re landing. This helps ground your own revenue assumptions in reality.

- Create Multiple Scenarios: This is non-negotiable for a new business. Don't just build one forecast; build three. A best-case, a worst-case, and a most-likely scenario. This acknowledges the uncertainty you’re facing and gives you a range of potential valuations, which is far more useful than a single number that’s probably wrong.

Using this approach, your discounted cash flow model becomes a powerful tool for stress-testing your business plan.

How Do I Pick a Discount Rate for My Business?

Choosing a discount rate can feel like the most abstract part of the whole process, but you can break it down into a simple, logical decision. Your discount rate is just a number that represents how risky your future cash flows are. The higher the risk, the higher your discount rate should be.

For a freelance business, you can build your discount rate from the ground up. Start with a baseline and then add a little extra for the specific risks you face.

Start with the Risk-Free Rate: This is your foundation. It’s the return you could get on an investment with virtually zero risk, like a stable government bond. In the Eurozone, this might be around 2-4%.

Add a Market Risk Premium: This accounts for the general risk of being in business instead of just holding a safe asset. A typical premium here might be 5-7%.

Add a Freelancer-Specific Risk Premium: This is where you tailor the rate to your unique situation. Think about what makes your income less certain and add a small percentage for each:

- Client Concentration: Does most of your income come from one or two clients? Add 2-4%.

- Industry Volatility: Are you in a fast-moving field like tech, or something more stable? Add 1-3% for more volatile industries.

- Project Pipeline Inconsistency: Is your income lumpy and unpredictable, or do you have steady retainers? Add 2-5% for a less reliable pipeline.

Tallying it all up, a freelancer might land on a discount rate anywhere from 10% for a very stable business to over 20% for a newer, riskier venture. This method makes sure your rate is a true reflection of your unique risks, which in turn makes your final discounted cash flow valuation far more meaningful.

A long-term valuation gives you a strategic map, but managing day-to-day finances is how you complete the journey. Billzy helps you turn your projected cash flows into actual, on-time payments. With a clear dashboard for all your invoices and a 90-day cash flow forecast, you can stop chasing payments and start building the future value you’ve calculated. Take control of your cash flow today by exploring Billzy.

Produced via the Outrank tool

Ready to Get Paid Faster?

Create professional invoices and track payments in seconds with Billzy.

Start Free Today