Electronic Funds Transfer: Master EFT for Faster Freelance Payments

When you hear the term electronic funds transfer (or EFT), it's really just a straightforward concept: moving money from one bank account to another through a digital system. No paper, no cash, just a secure, computer-based transaction.

For freelancers and consultants, this isn't just a convenience; it's the key to turning erratic payment cycles into a dependable income stream.

Why Electronic Funds Transfer Is a Game Changer for Freelancers

If you've ever been a freelancer, you know the feeling. You send off an invoice, and then the waiting game begins. The time between a client receiving your invoice and the money actually hitting your account can be a black hole of uncertainty, especially when you're relying on traditional methods like cheques.

Waiting for a cheque to arrive, then for it to clear, can drag on for weeks. That's not just annoying—it actively disrupts your cash flow and makes business planning a nightmare.

Think of it this way: an EFT is like sending an instant message, while a cheque is like sending a letter through the post. One is nearly immediate and confirmed, while the other is slow, unpredictable, and can easily get lost along the way. Shifting to EFTs isn't just a minor administrative change; it's a strategic decision that fundamentally improves the way your business runs.

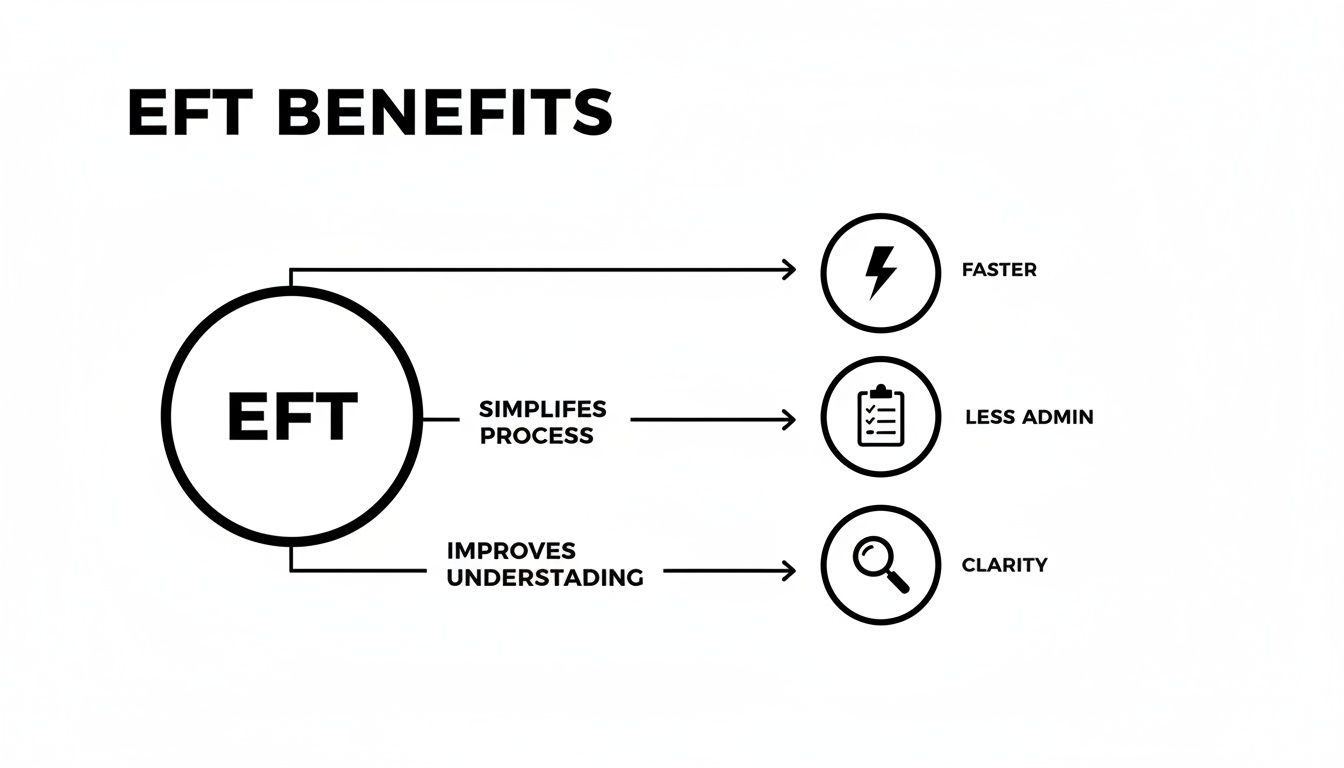

The Core Benefits for Your Business

Making the switch to EFT payments offers real, immediate benefits that go well beyond just speed. It brings your whole financial process into the 21st century.

Here's what you stand to gain:

- Less Admin, More Focus: Forget about making special trips to the bank or chasing down cheques that are supposedly "in the mail." EFTs cut out the manual busywork, freeing you up to focus on what you actually do best.

- Serious Security: Digital transfers are shielded by robust, bank-level encryption. This makes them far safer than paper cheques, which can be lost, stolen, or fraudulently altered. In fact, official Treasury data shows that paper cheques are a staggering 16 times more likely to be compromised than electronic payments.

- Clearer Cash Flow: When payments arrive on a predictable schedule, you get a much sharper view of your financial position. This clarity is crucial for making smart business decisions, whether you're investing in new software or planning your next quarter. You can find more tips on effective invoice tracking for freelancers to get the most out of this.

By making it incredibly simple for clients to pay you digitally, you're removing the biggest source of friction in the payment process. This small step not only encourages quicker payments but also polishes your professional image, signalling that you run an efficient, modern operation.

When a client says they're paying you via an electronic funds transfer, it's easy to nod along. But what does that actually mean for your bank account and your timeline? EFT isn't a single type of payment; it's a catch-all term for several different ways money can move digitally.

Knowing the difference between these methods is crucial. It helps you set clear expectations with clients, understand why some payments show up in hours while others take days, and forecast your cash flow much more accurately.

Think of it like shipping a package. You can choose the slow, economical standard post or pay a premium for an overnight courier. Both get the job done, but the timing and cost are worlds apart. It's the same with EFTs.

This is why moving away from older payment methods is so powerful—it gives you faster transactions, cuts down on admin, and brings real clarity to your finances.

Let's break down the main players you'll come across as a freelancer.

ACH Transfers: The Dependable Workhorse

You've probably already received an Automated Clearing House (ACH) transfer without even realising it. This is the system that powers most direct deposits, recurring bill payments, and standard client invoices.

ACH transfers work by processing transactions in large batches at set times throughout the day. This batch-processing approach is what makes them so incredibly cost-effective—often free or just a few cents. The trade-off for that low cost? They aren't instant. You can typically expect an ACH payment to land in your account within 1 to 3 business days.

Because they're so reliable and affordable, ACH transfers are your go-to for:

- Monthly retainers from ongoing clients.

- Standard milestone payments that aren't on a tight deadline.

- Any situation where cost-effectiveness and predictability outweigh the need for speed.

Wire Transfers: The Express Option

If ACH is the reliable postal service, a wire transfer is the dedicated courier. Wires send money directly from one bank to another, often clearing in just a few hours on the same business day. There's no batching, just a straight shot.

That speed and immediacy come with a higher price tag. Wires are the most expensive EFT option, with fees often ranging from €15 to €45, particularly for international transfers. The good news is the sender usually covers this fee. Once a wire transfer is confirmed, the money is considered final and cleared, providing excellent security for significant payments.

A wire transfer is the perfect solution when you need guaranteed funds right away, like for a final project settlement or a very large invoice. In those high-stakes moments, the speed and finality are well worth the cost.

Global and Instant Payment Systems

The world of EFTs doesn't stop with ACH and wires. A couple of other important systems are worth knowing about, especially if you work with international clients or want to stay ahead of the curve.

If you have clients in Europe, you'll likely encounter the Single Euro Payments Area (SEPA). This system was designed to make cross-border euro transfers as seamless and cheap as local ones, which is a massive help for freelancers with a European client base.

A newer and exciting development is the rise of Real-Time Payments (RTP) networks. Just as the name implies, RTPs are instant. The money hits your account 24/7, 365 days a year, with no waiting. While not as widespread as ACH just yet, their adoption is growing fast and they're quickly changing the game for B2B payments.

Comparing Common Electronic Funds Transfer Methods

To make it even clearer, here's a quick-glance table comparing the most common EFTs you'll use as a freelancer. Think of it as your cheat sheet for understanding how and when you'll get paid.

| Transfer Type | Typical Speed | Associated Cost | Best For |

|---|---|---|---|

| ACH Transfer | 1-3 business days | Low to none | Regular, non-urgent payments like retainers and standard invoices. |

| Wire Transfer | A few hours (same business day) | High (€15-€45+) | Large, time-sensitive payments where speed and finality are critical. |

| SEPA Transfer | 1 business day | Low to none | Receiving euro payments from clients within the 36 SEPA countries. |

| Real-Time Payment (RTP) | Instant (24/7) | Varies, often low | Immediate payment needs; great for last-minute invoices. |

Each method has its place. Understanding them means you're no longer just passively waiting for money to appear—you're in control of your cash flow and can have more informed conversations with your clients about payment terms.

The Future of Payments: Instant and Secure EFT

The world of payments is getting a serious upgrade, and it's all being driven by two simple but powerful demands: speed and security. For too long, we've just accepted that it takes days for money to move from one account to another. Those days are coming to an end. The future is instant, and it's built to be secure from the ground up.

For freelancers and consultants, this is fantastic news. It means the frustrating delay between getting that "payment sent" email and actually seeing the money in your account is about to become a thing of the past.

The Rise of Instant Payments

Financial centres around the world are pushing to make instant transfers the new standard, not just a pricey add-on. This isn't just about making things a little faster; it's about fundamentally changing our expectations for how money should move.

Take Luxembourg, for example. Big changes are on the horizon. From 9 October 2025, every bank in the country will be required to make instant payments the default for all euro transfers. This means your client's payment will hit your account in seconds, 24 hours a day, 7 days a week. No more waiting for "banking hours" or watching your cash flow stall over a weekend. You can read more about Luxembourg's new instant payment standards to see the full picture.

This shift to real-time processing turns getting paid into something you can count on, happening the moment it's supposed to.

Verification of Payee: A Digital Bouncer for Your Bank Account

Speed is great, but it's nothing without security. That's why one of the most important developments happening alongside instant payments is the rollout of Verification of Payee (VoP) systems.

Think of VoP as a digital bouncer for your bank account. Before a payment is even sent, the payer's bank does a quick, real-time check with your bank. It confirms that the name on the payment instruction actually matches the name on the account number (IBAN) they've entered.

This one simple step is a massive leap forward for security. It almost completely eliminates payments going to the wrong account because of a typo, and it's an incredibly effective tool against invoice fraud and scams.

VoP gives both you and your client peace of mind. They know their money is going exactly where it's intended, and you know you're protected from common errors or malicious attacks.

This powerful combination—instant processing and rock-solid verification—is what the future of EFT looks like. It's creating a world where freelancers can finally get paid not just quickly, but safely, giving you the confidence and control you need to manage your business effectively.

How to Set Up Your Invoices for Flawless EFT Payments

Here's a simple truth about getting paid on time: make it incredibly easy for your clients to pay you. An invoice with missing or confusing details is a roadblock. It creates friction, forcing your client's accounts team to chase you for information, which inevitably delays your payment.

To make sure your electronic funds transfers go through without a hitch, your invoice needs to be a crystal-clear roadmap. Think of it as a pre-flight checklist for your money. One wrong digit in an account number can send the funds into a digital black hole, leading to weeks of frustrating follow-ups for both you and your client.

Your Essential EFT Invoice Checklist

To sidestep these common pitfalls, dedicate a specific section on your invoice to payment details. Before you hit send, give this list a final once-over—it only takes a moment and can save you days of waiting.

- Your Full Legal Business Name: Use the exact name your bank has on file, not a trading name or an abbreviation.

- Bank Name: The full, official name of your bank.

- Account Number: The specific account where you want the funds to land.

- IBAN (International Bank Account Number): Absolutely essential if you work with clients in Europe (including Luxembourg) or many other countries. This combines all your details into a single, standardised format that international banking systems recognise.

- SWIFT/BIC Code (For International Payments): This is your bank's unique global address. It's a must-have for any non-domestic wire transfers and ensures the money finds its way to the right institution.

Placing this information under a clear heading like "Payment Instructions" or "Bank Details" leaves no room for error or guesswork.

Clear and Professional Payment Instructions

Listing the details is great, but adding a short, professional note can guide your client and show you mean business. It's a small touch that reinforces your professionalism and makes your instructions impossible to miss.

Invoice Note Example:

"For your convenience, please remit payment via electronic funds transfer using the bank details provided below. Kindly include the invoice number in the payment reference. Thank you!"

This simple sentence works wonders. It politely steers them towards EFT, puts all the necessary info right at their fingertips, and—crucially—asks for the invoice number in the reference field. This last part makes reconciling the payment on your end a breeze. By preparing your invoices with this level of care, you're not just sending a bill; you're clearing the path for your money to arrive smoothly and on schedule.

Tracking Payments and Forecasting Your Freelance Cash Flow

Let's be honest, hitting 'send' on an invoice doesn't mean the job is done. The real work—the waiting game—is just beginning. Especially when dealing with EFTs, which all come with their own settlement timelines, that uncertainty can be a real source of stress. This is where you need to shift from just chasing payments to proactively managing your business's financial health.

Trying to juggle this with a spreadsheet is a recipe for disaster. Before you know it, you're lost in a sea of cells, manually updating payment statuses, guessing at processing times, and trying to make sense of your future income. It's a purely reactive way of working, and it leaves you constantly wondering where you actually stand financially.

Moving Beyond Manual Spreadsheets

This is where modern invoice tracking tools come in. Forget the static, clunky spreadsheet. Instead, picture a living, breathing dashboard that gives you a single, clear snapshot of your finances. It's a command centre built to answer a freelancer's most pressing questions at a glance.

Imagine logging in and instantly seeing all your invoices neatly sorted:

- Pending: Invoices you've sent that aren't due yet.

- Due Soon: A heads-up on payments coming up on their deadline.

- Overdue: A clear list of late invoices that need a follow-up.

This kind of organisation transforms financial guesswork into genuine clarity. For more tips on getting this set up, check out our guide on how to track freelance invoices effectively.

Gaining Clarity with Cash Flow Projections

Real financial control isn't just about what you're owed today; it's about what you can expect tomorrow. This is why cash flow projections are such a powerful feature. A good tracking system can look at your outstanding and recurring invoices to give you a solid forecast of your income over the next 30, 60, or 90 days.

That kind of foresight is a game-changer. It helps you make smarter decisions about when to take on a new client, whether you can afford that new piece of software, or how much to put aside for taxes—all based on a realistic picture of your future earnings.

Having a clear projection of your upcoming revenue helps you manage the natural peaks and troughs of freelance income. It replaces financial anxiety with strategic confidence, allowing you to plan your business growth with real data.

This is more important than ever as payment methods evolve. In Luxembourg, for instance, the digital payments scene has exploded, with e-commerce and instant bank transfers becoming the norm. With over 90% digital adoption in key sectors, clients expect to pay you faster using integrated bank transfers and digital wallets. A sophisticated tracking system is no longer a luxury; it's essential for managing this accelerated cash flow.

How to Troubleshoot Common EFT Payment Issues

Even with the best-laid plans, an EFT payment can sometimes go off track. A payment might be a few days late, the amount could be off, or in rare cases, the money seems to have disappeared into the ether. When this happens, the best approach is to stay calm, communicate clearly, and work through it methodically.

Flying off the handle or firing off an angry email is a surefire way to damage a good client relationship. Instead, treat it as a routine administrative hiccup that you and your client can sort out together. This approach not only solves the problem but also reinforces your professionalism.

Investigating a Delayed Payment

If a payment hasn't landed in your account on time, don't jump to conclusions. Remember, different EFT types run on different schedules. An ACH transfer can take a few business days to clear, whereas a wire transfer is typically much faster.

Here's a simple, step-by-step process to follow:

- Check Your Invoice: Before anything else, pull up your invoice. Give the due date and your bank details a quick once-over. You'd be surprised how often a simple typo is the culprit behind a failed payment.

- Send a Polite Enquiry: If the payment is officially past due, a brief, friendly email is all you need. Something like, "Hi [Client Name], just following up on invoice #[Invoice Number]. Could you please let me know the status of the EFT payment?" works perfectly.

- Request a Confirmation Number: If your client says they've sent the payment, ask them for the transaction confirmation or reference number. This little piece of data is your proof that the transfer was initiated on their end.

When late payments become a habit, it signals a bigger problem. Knowing what to do when a client doesn't pay is essential for setting boundaries and keeping your cash flow healthy.

Once you have the confirmation number, you can get in touch with your own bank. They can use that reference to trace the payment and find out exactly where it is. If it turns out the issue was on the client's side, you can share what your bank found and ask them to follow up with their financial institution.

Common Questions About Electronic Funds Transfers

Moving money online can feel a bit abstract, so it's natural to have a few questions. Let's clear up some of the most common ones that freelancers and consultants run into.

Are Electronic Funds Transfers Actually Secure?

Yes, absolutely. EFTs are one of the most secure ways to move money. Banks and financial institutions layer on heavy-duty protections like advanced data encryption and always-on fraud monitoring systems to keep every transaction safe. Compared to a paper cheque that can be lost or stolen, it's a massive security upgrade.

Plus, new security measures are always being rolled out. Systems like Verification of Payee (VoP) add another checkpoint by making sure the recipient's name matches the account details before any money is sent. This simple step is a powerful way to stop fraud and prevent payments from accidentally landing in the wrong account.

What's the Difference Between an EFT and a Wire Transfer?

This is a great question because the terms are often used interchangeably. The easiest way to think about it is that electronic funds transfer is the umbrella term for all digital payments. A wire transfer is just one specific type of EFT, usually the premium option.

Wires are the go-to for really large, time-sensitive, or international payments. They move directly from one bank to another, often in real-time, but they come with a higher price tag. On the other hand, common EFTs like ACH transfers are processed in batches. This makes them much cheaper (or even free), but it also means they take a little longer to arrive.

What Should I Do If an EFT Hasn't Arrived?

First, don't panic. The first step is to check the standard processing time for that specific payment type. For example, an ACH transfer often takes 1-3 business days. Remember to factor in weekends and public holidays, as they can add to the timeline.

If that window has passed and you still don't see the money, reach out to your client. Politely ask them for a payment confirmation receipt or a transaction reference number. This proves the transfer was sent on their end. With that little piece of information, you can then call your bank and ask them to trace the payment. It's a calm, professional way to sort things out.

Get a clear view of your finances

Billzy provides a simple dashboard to track all your invoices, project your cash flow, and help you get paid on time. Free for up to 10 invoices.

Start Tracking for Free →